...

- Go to Dictionaries > Accounting > Accounting operations

- Use the New accounting operation context menu item or the same option of the Edit main menu item. You can also use a separate New accounting operation item in Dictionaries > Accounting

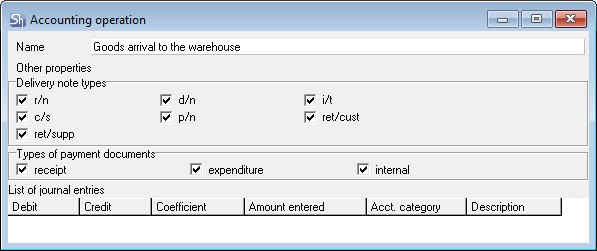

- In the window that opens, fill in the fields

- Name — specify the operation name that will be used when selecting operations in documents

- Set the flags for delivery notes and payment documents to which the added operation is applicable in the areas of the Delivery note types and Types of payment documents window windows

- Enter standard journal entries for the operation in accordance with the rules for the amount distribution

- Save the new accounting operation (the main menu item "Document" - "Save Document" or the operation using the Document > Save document main menu item or the button on the toolbar).

In the table, you must define should create a list of typical postings corresponding to journal entries for this operation. There is no limit on the number of entries for a transactionan operation.

To add a new line, press the [Insert] or [↓] key or use the "Add line" context menu item.A loan is

- Credit — an account from which funds are debited

...

- Debit

...

- — an account to which funds are deposited

...

- Coefficient

...

- — a coefficient with which funds will be transferred between accounts

...

- Amount

...

- entered — specify the document amount

...

- — select from the

...

- preinstalled list

...

- — that will be posted.

List of amounts heldentered:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

...

|

|

...

|

|

...

| |

|

|

|

|

|

...

|

|

|

|

|

|

|

|

|

|

Acct. category — posting of the document amount may depend on the Accounting categories of delivery note Holiday pay

Procurement VAT (expense)

Extra charge w / n

Purchasing premium (expense)

VAT markup

Compensator w/n

NSP markup

VAT compensator

Extra charge

Accounting category - posting the amount of the document on invoices may depend on the "Accounting categories" of invoice items. If the field is left blank, then the entire amount of the invoice delivery note will be posted. If the field is filled in, then only goods with the selected category will be selected from the goods of the invoicedelivery note items, and their amount will be posted to upon the specified postingentry.

"Accounting Acct. category" is used when creating a transaction an operation if the amounts for of different goods must be posted to different accounts.

Description - — a brief description of each transaction entry that will be displayed in the reports. The field is optional.

If the transaction entry was created by mistake, then delete the line using the Delete line context menu item "Delete line" or use the keyboard shortcut [Ctrl+Del] keyboard shortcut.