To add a new accounting operation:

- Go to Dictionaries > Accounting > Accounting operations

- Use the New accounting operation context menu item or the same option of the Edit main menu item. You can also use a separate New accounting operation item in Dictionaries > Accounting

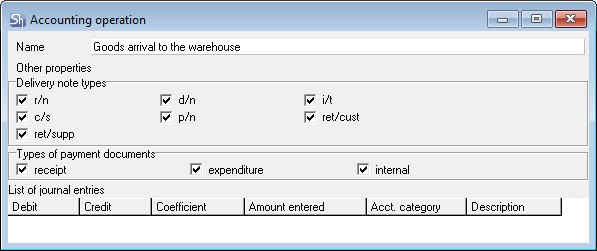

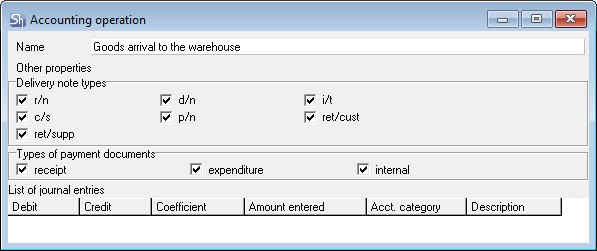

- In the window that opens, fill in the fields

- Name — specify the operation name that will be used when selecting operations in documents

- Set the flags for delivery notes and payment documents to which the added operation is applicable in the areas of the Delivery note types and Types of payment documents window

- Enter standard journal entries for the operation in accordance with the rules for the amount distribution

- Save the new accounting operation (the main menu item "Document" - "Save Document" or the button on the toolbar).

In the table, you must define a list of typical postings corresponding to this operation. There is no limit on the number of entries for a transaction.

To add a new line, press the [Insert] or [↓] key or use the "Add line" context menu item.

A loan is an account from which funds are debited.

Debit is an account to which funds are deposited.

Coefficient - the coefficient with which funds will be transferred between accounts.

Amount to be posted – from the list, specify the amount of the document (select from the preset list) that will be posted.

List of amounts held:

Purchasing b / n (incoming)

NSP compensator

Purchase VAT (receipt)

H/N compensator

Purchasing NSP (receipt)

Vacation pay w / n

Purchasing high school (parish)

Selling VAT

Purchasing w / n (expense)

Holiday NSP

Purchase VAT (expense)

Holiday pay

Procurement VAT (expense)

Extra charge w / n

Purchasing premium (expense)

VAT markup

Compensator w/n

NSP markup

VAT compensator

Extra charge

Accounting category - posting the amount of the document on invoices may depend on the "Accounting categories" of invoice items. If the field is left blank, then the entire amount of the invoice will be posted. If the field is filled in, then only goods with the selected category will be selected from the goods of the invoice, and their amount will be posted to the specified posting.

"Accounting category" is used when creating a transaction if the amounts for different goods must be posted to different accounts.

Description - a brief description of each transaction that will be displayed in the reports. The field is optional.

If the transaction was created by mistake, then delete the line using the context menu item "Delete line" or use the keyboard shortcut [Ctrl + Del].