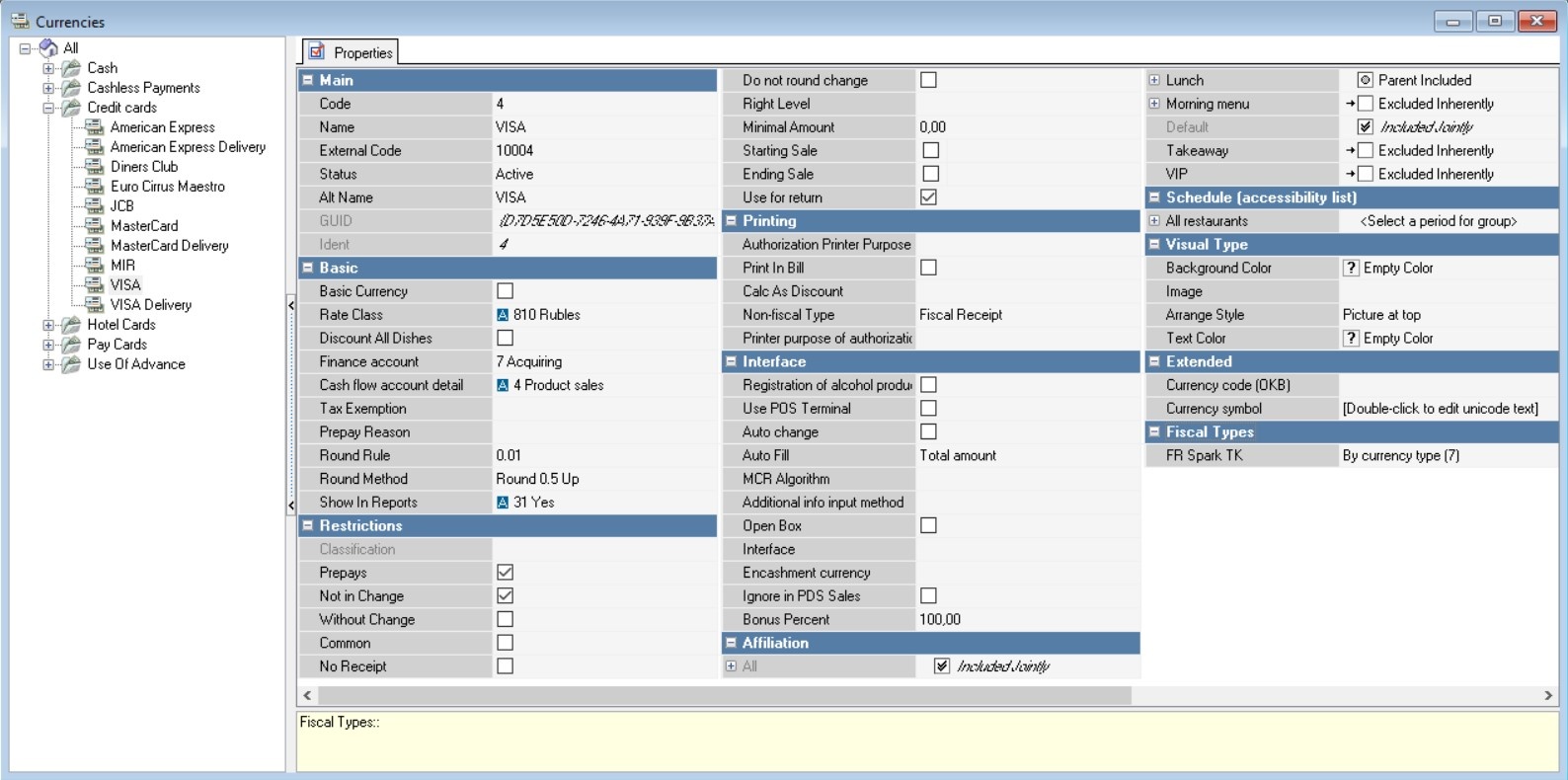

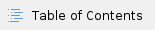

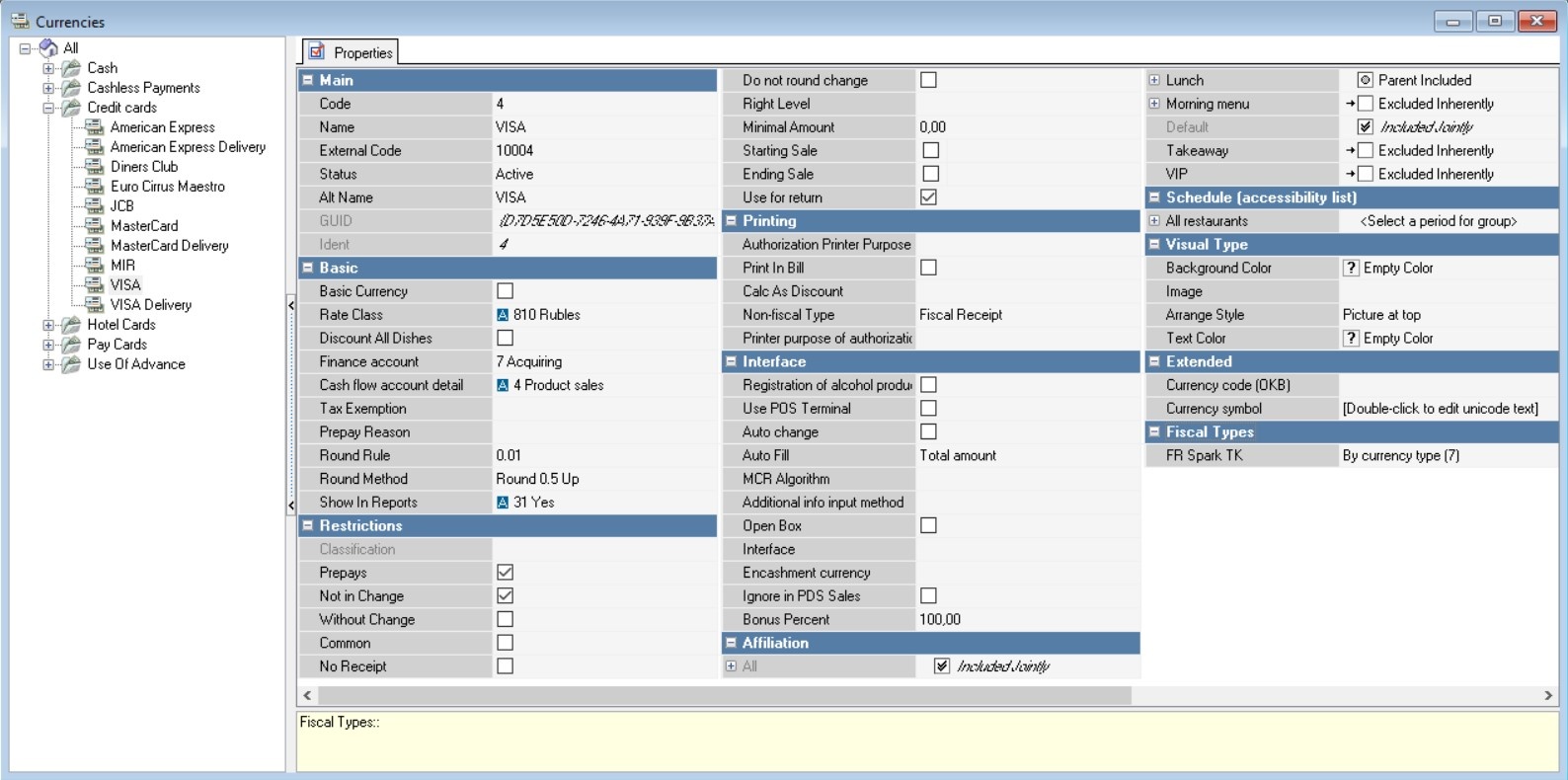

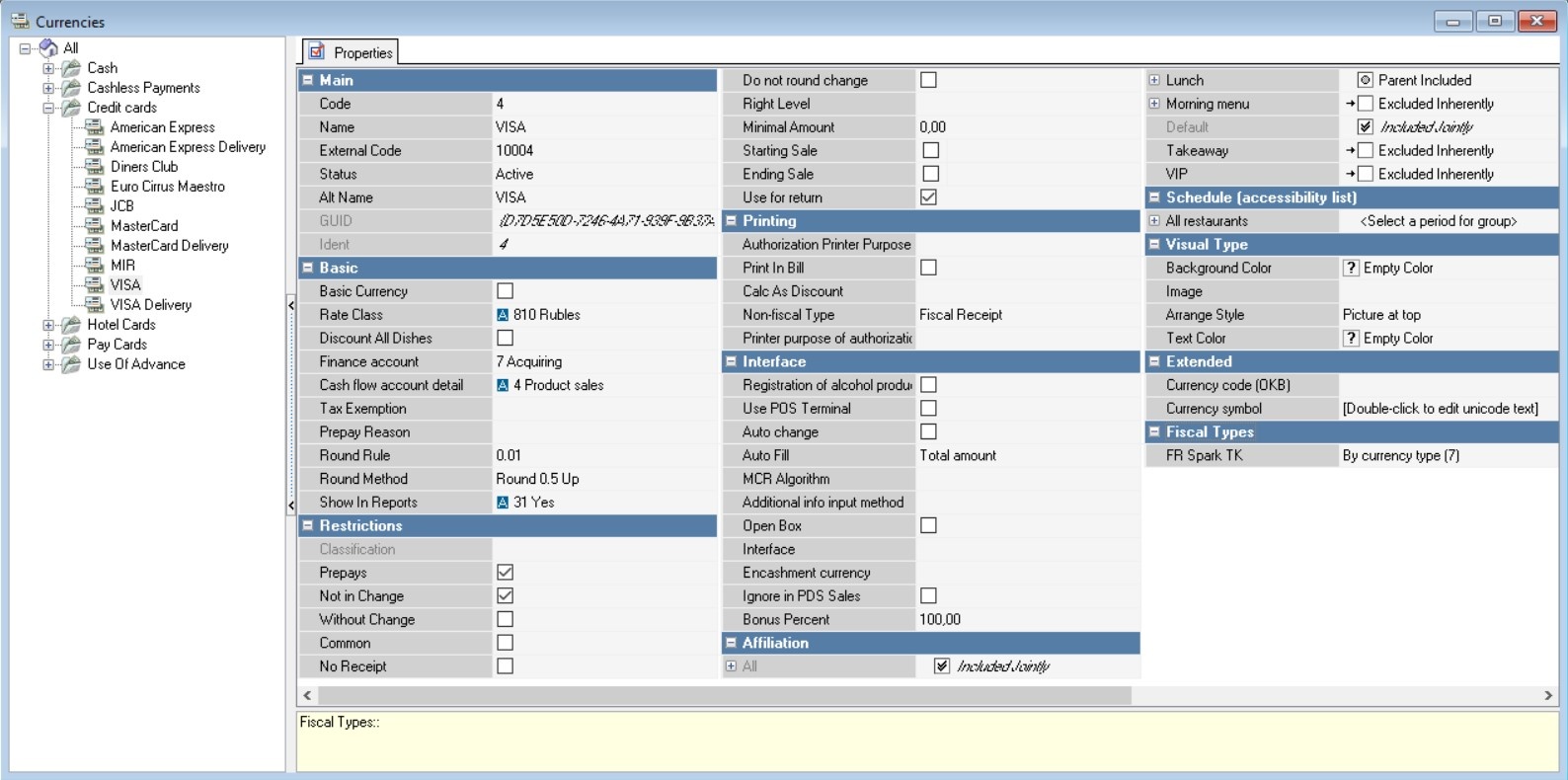

The properties of currencies are presented in 9 sections.

The properties of currencies are presented in 9 sections.

Main

- Code – a unique code of the directory element in the system. It is assigned automatically, but can be changed manually;

- Name – the name of the directory element;

- Alt. Name – the name of the element in an alternative language;

- Status – the status of the directory element;

Basic

- Basic Currency — the currency in which menu item prices are calculated, a guest bill is printed, and data is displayed in reports, except for tax data. Only one currency can be basic.

Rate class — the rule for converting the selected currency into the national currency. Used to set up exchange rates, coupons, etc.

National currency is the currency of the fiscal receipt and tax calculation. The exchange rate of other currencies is calculated relative to it.

It is configured in the Regions directory. The change in national currency at the cash register will only take effect after the general shift is closed. |

- Finance Account — in this field you can specify a sub-account, used for automatic postings to CFS (Cash Flow Statement).

- Cash Flow Account Detail — a cash flow item used for automatic postings in the CFS (Cash Flow Statement).

Discount All Dishes — can be applied if a payment made with the specified currency includes a discount. In such cases, this flag should be enabled (the "Discount (Markup)" property must be filled out). When this flag is set, the discount or markup will be calculated based on the total order amount, applying to all menu items. If the flag is not activated, the discount or markup will only apply to the sum of the menu items paid for using the discounted or marked-up currency. For composite dishes, calculations will either include the entire order's total or only the portion paid using the discounted currency.

Discount (Markup) — specify the discount/markup that applies to payments in this currency.

Discount and markup cannot be assigned to national and base currencies.

To assign a discount/markup on a currency, the "Redistribute discounts" parameter must be disabled.

Discount/markup can be assigned to payment, order and location.

If the discount has the "Changeable value" checkbox checked, the discount value will be taken from its details and cannot be specified at the station. |

- Tax Exemption — If payment in this currency provides a tax benefit, select it from the list in this field

- Round Rule — select from the list the value to which the amount is rounded when calculating the order. For example, rounding to 0.01 rub or to 1 rub, etc.

- Round method — select from the list the principle of rounding amounts in calculations.

- Tip Charge — Enter the unallocated margin for handling tips.

Show In Reports — whether to display amounts closed on currency in reports. Applies to SQL queries, cubes, and cash register reports. Does not affect IR reports.

Restrictions

- Classification (field is absent if the currency is national) – definition of the classification and categories of menu items that can be paid for in this currency

If you select a classification and do not set the flag in any category, then it will not be possible to pay for a dish with this currency. Only non-distributed markups can be paid with this currency. In addition, if discounts/markups "On payment" are defined for such currencies, they cannot be applied, since any discounts/markups are applied only to the amount according to the price list (amount excluding taxes).

- Example 1. A certain company pays for its employees' meals through non-cash transactions under the categories of "Food" and "Non-alcoholic beverages." For meal payments, a currency type called "Non-cash payment" has been created with restrictions set on the categories "Food" and "Non-alcoholic beverages," classified as "For reports."

- Example 2. The non-distributable "Entrance Fee" surcharge can be paid with a special currency called "Flyer". For this currency, a limit should be set for any classification without selecting categories.

If a classification is selected, the Without Change flag cannot be cleared for the currency. This restriction is introduced to prohibit cashing out currencies that are prohibited for payment for certain categories of menu items.

A currency that has a category restriction cannot be used as a prepayment. |

Not In Change — if the checkbox is selected, it is not possible to give change in this currency. For example, in a casino, besides money, chips can be used to pay the bill, but according to the establishment's rules, chips cannot be received as change.

Without Change — if the checkbox is checked, it is forbidden to give change for payments in this currency. It is used to prohibit cashing out funds from credit cards, bonuses, coupons, etc.

The checkbox is automatically set if the currency is restricted by category.

If a currency has a "Without change" checkbox and a tip markup is specified, then the change from the payment for this currency is automatically included in the tip. |

- Prepays — if the checkbox is checked, you can make a prepayment in currency.

- Right Level — the right to work with an element at the cash register.

- Starting Sale — the date when the item begins to be utilized.

- Ending Sale — the date when the item ceases to be utilized.

- Do not round change - do not round up the prepayment (and change) if the exchange rate is high (higher than the base currency rate).

- Max. Percent — the maximum percentage of the total order amount that can be paid in this currency.

- Do not accept — if the checkbox is selected, this currency cannot be used to pay for an order or replenish funds. However, giving change in this currency is allowed.

- Minimal amount — the minimum order amount that can be paid in this currency.

- Use a combo category — if the currency is limited by category, then when working with combo meals, the category of the combo element will be taken from the properties of the combo meal.

- Use for return — if the checkbox is checked, the currency can be used to return goods.

Printing

- Authorization Printer Purpose — allows you to specify the printer purpose (assignment) directly when using multiple terminals.

- Print in bill — print the amount to be paid in this currency in the guest bill. For example, used in airports where the guest can pay in different currencies.

- Non-fiscal Type — the method of reflecting the amount closed in the selected currency in the fiscal receipt:

- Fiscal Receipt — if the flag is set, the fiscal printer prints the amounts accepted for payment in currencies of this type on the receipt

- Fiscal discount — adding a discount to the fiscal receipt for the amount paid in this type of currency

- Do not print receipt — do not print a fiscal receipt if there is a payment in this type of currency

- Total with subtraction — print a receipt without a breakdown for the amount minus the payment made in this type of currency

- Print discount — specified when using payment in currency as a discount.

Calc as discount — payment in this currency is reflected in the receipt as a discount. Select a discount from the Preset discounts > Service discounts > Payment as a discount group. The fiscality type will be automatically changed to "Print discount".

- Reserve fiscal part — the setting allows you to reserve 1 kopeck for each unit of the menu item in the order. Used for combined payment with fiscal and non-fiscal currency, for example, bonuses.

If the flag is set, the order cannot be completely closed in the currency with the fiscal type "Print discount". The remaining amount must be closed in the fiscal currency. To learn how to pay for an order in two currencies at the cash register, read the article Combined payment.

For non-fiscal currency, for which the previous field "As a discount" is not filled, the fiscal part reservation will work only with proportional distribution. You can set this setting in the menu Settings > Setup > Listed properties > Payment distribution mechanism. In the Payment distribution mechanism tab, you need to go to the Proportionally property and make sure that the setting is activated.

The Payment distribution mechanism determines how the payment will be made when using multiple currencies. It can take the following values: - FIFO — payment of the entire check is made in order. For example: part of the menu items are paid for with bonus points, then the remainder of the check—in rubles

- Proportionally — payment for each check item, except for exceptions, is divided equally between the currencies used. For example: for each item on the check, one half of the menu item is paid for with bonus points, the other—in rubles.

|

If the "As a discount" field is filled in, but the "Reserve fiscal part" flag is not set, the order can be paid in full in the currency for which the value is set. In this case, kopecks are not reserved for fiscal payment.

Interface

- Auto change — if the checkbox is checked, when paying with this currency with a surplus, change will be given automatically.

- Additional info input method — when paying in foreign currency, you need to enter additional information.

- Auto Fill — the principle of entering the payment amount:

- No autofill — the amount to be paid is entered manually, face values become available.

- Total amount — the amount to be paid is generated automatically, it is equal to the total amount of the order. To pay for the order, you only need to select the currency.

- Total amount + confirmation — the amount to be paid is generated automatically. When paying, a warning appears, for example, "Do you want to pay the check using Visa currency?".

- One-time — payment in one unit of currency, suitable for the coupon currency.

- Ignore in PDS Sales — do not transfer information about payments in this currency to loyalty programs.

- Open Box — if the checkbox is checked, when selecting this currency at the cash register to accept payment or give change, the cash drawer will automatically open.

- Bonus Percent — percentage of the order amount paid in this currency, on which bonuses will be accrued.

- MCR Algorithm — algorithm for reading magnetic card, information about the described currency. MCR algorithms are available for selection, which have "currency" selected in the "Application area" property, and no other currency is selected in the "Object" property.

- Interface — select from the list the interface used to communicate with other programs. For example, the PDS interface.

- Encashment currency — in the property you can specify the cash currency for cashing it. Works provided that the operation is supported by the fiscal registrar.

Schedule (accessibility list)

- All restaurants — currency availability for each restaurant. The default period is "Always". If the currency should not be displayed in the restaurant, select the preset period "Never". If necessary, you can specify a different period set in the Periods directory, for example, to display the currency from 9 to 11 am.

Affiliation

In this section, please indicate your trade group affiliations.

Visual Type

- Background color — the background color of the button. You can select a color from the list or from the palette, which is called by double-clicking the left mouse button in the property value area;

- Arrange Style — the relative position of the image and text;

- Image — selecting an image for the object;

- Text color — the color of the text. You can select a color from the list or from the palette, which is called by double-clicking the left mouse button in the property value area.

Fiscal Types

In this section, you must specify the code of the fiscal registrar section to which the payment in this currency will be related. For example, if the FR "Atol" is used, then for the currency group "Cash" you must specify "0". The values of fiscal payment types for fiscal registrars should be clarified with the manufacturers of fiscal registrars.

The properties of currencies are presented in 9 sections.