To reduce the number of documents in the StoreHouse 5 database and delete "unnecessary" periods of the sets, you can use the Unnecessary data removal function in the Sdbman.exe application. This function works since StoreHouse version 5.109.401.

The following documents can be removed before the specified date:

When removing the invoices, the system forms incoming balances for the specified date. You can remove invoices:

The following documents are left without changes:

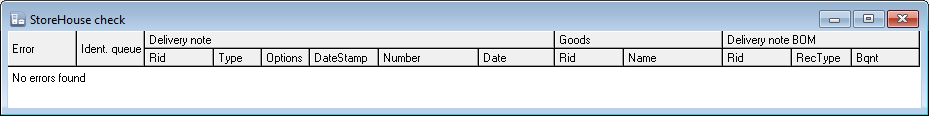

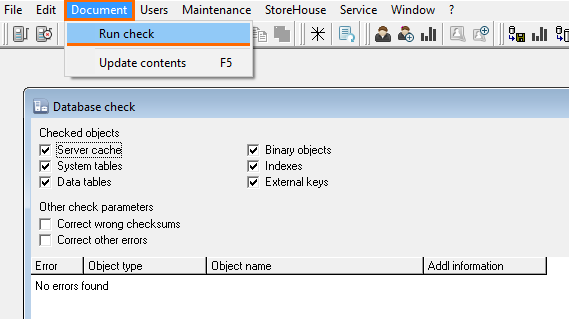

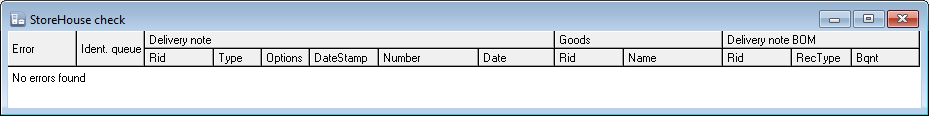

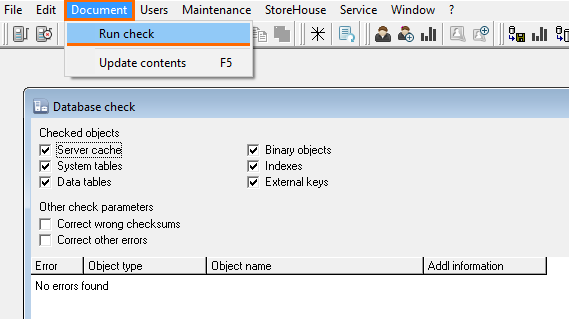

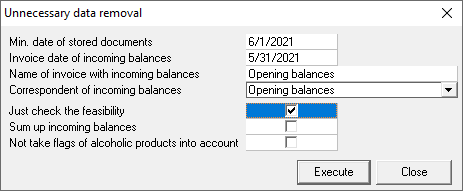

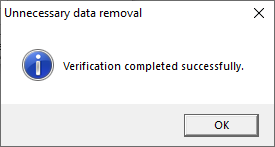

First, you need to check the database for errors. For this:

If errors are found, they must be corrected before removng the documents.

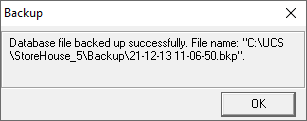

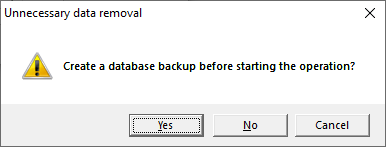

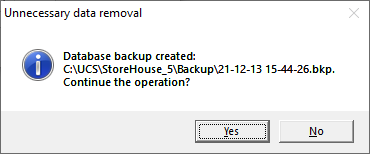

Back up your database. For this:

Done, you can proceed to remove data.

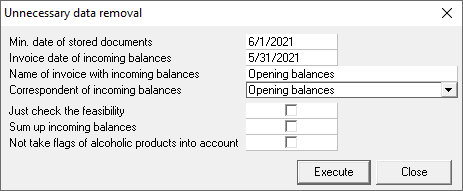

Invoice date of incoming balances — the date on which non-editable invoices will be generated for organizing incoming balances.

If you need to receive balances on 06/01/2021, then the Invoice date of incoming balances must be set on 05/31/2021.

The date of invoices of incoming balances must be less than Min. date of stored documents |

Correspondent of incoming balances — a special correspondent of StoreHouse who will participate as an invoices supplier or recipient for the formation of incoming balances. It must be selected from the database. If the correspondent is absent in the database, then it must be added there.

For more information on the settings, see the Data removal parameters article. |

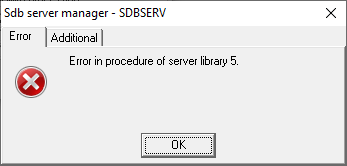

If the removal is impossible, the system will display an error message. For more information about errors, see the Possible Errors article.

To check if the procedure was successful, open the SH.exe application. Go to Documents > Delivery notes. Specify the parameters and click Apply.

In the list of notes, incoming balances will be formed in accordance with the specified rules for each division of the database.

If in the cut-off period the balances have zero or negative value, the first delivery note by date in the stored period is searched for for the corresponding FIFO queue.

If this is a receipt document, then there is no need to save the incoming balance — the next write-off will be based on it, and it will determine the cost of the subsequent expense.

If this is an expense document, then the receipt document in the period to be deleted is used to form its cost price, and it is necessary to create receipt notes of incoming balances. But since the balance on the date of period cutting was not positive, a mirrored expense note is created to compensate for the receipt one. Thus, this expense note sets the incoming balance to zero.