RK7 fiscal issues

1. General

1.1. The main purpose of all fiscal devices is saving sales data to fiscal memory.

1.2. Fiscal modules use specific data exchange protocol with cash station application.

1.3. Some fiscal printers are able to print non-fiscal data (any document), others allow you use only 1 field to add extra info, rest forbid printing anything from outside.

1.4. You may use several fiscal modules connected to 1 cash station at the same time.

1.5. There are 'fiscal type' properties used to link RK7 objects to fiscal device objects. Each kind of fiscal device uses 1 and the same fiscal type of 1 kind.

1.6. Some fiscal machines can print zero price goods or/and zero receipts. Others not. Get info from your fiscal machine protocol documentation.

1.7. Some fiscal printers require specific port settings like Parity=Even.

1.8. Fiscal register type information is stored in upgradefr.udb file. This file must be located in R-Keeper 7 distributive from version 7.1.0.0.

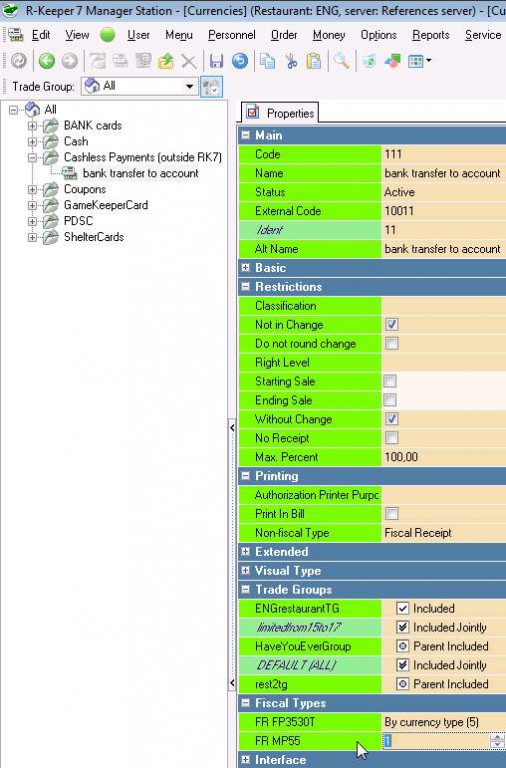

1.9. There is "Unfiscal" property for currency (and type) with one of the following options:

Fiscal receipt – all payments with that currency are registered in fiscal memory, cell defined by property "Fiscal type X" near that "FR name".

Do not print receipt – in case payment with that currency exists, receipt will not print (even if partial payment).

Add discount to amount – FR will print receipt, but for that currency payment amount add discount. In case FR does not support zero receipt amount, and only that amount payment exists, no receipt will be printed.

Substract from total – In case full amount - all substracted and no receipt printed, in case partial payment - will be one item in receipt "total" with fiscal currencies payments sum.

2. Specific drivers

2.1. Universal

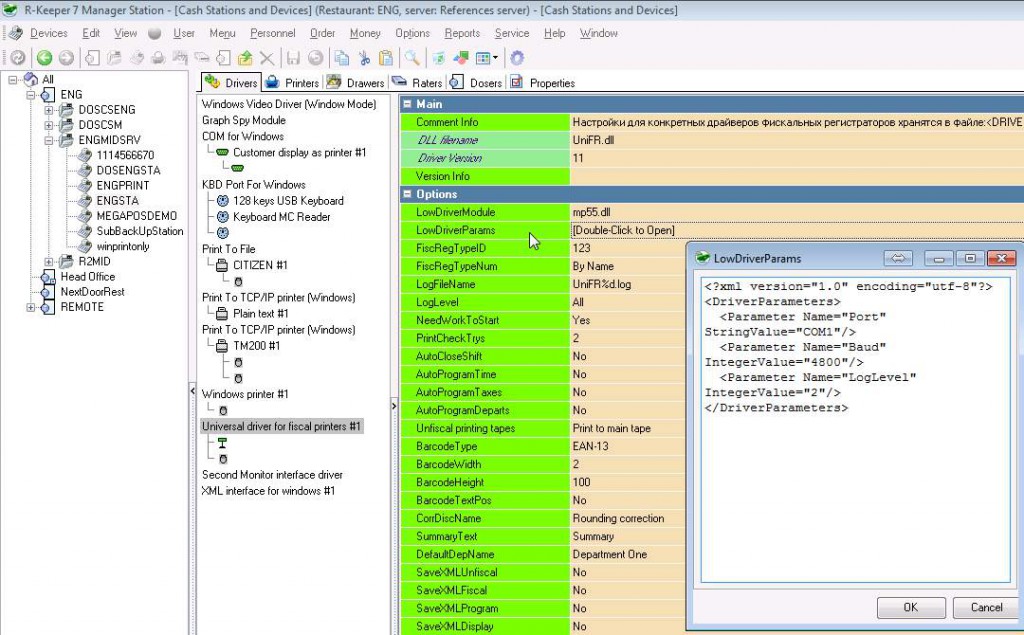

2.1.1. RK7 has got universal driver (adaptor) for fiscal printers. The adaptor driver name is UniFR.dll

2.1.2. In its properties:

2.1.2.1. LowDriverModule - you have to set which DLL file is driver itself.

2.1.2.2. LowDriverParams - child driver properties in XML format.

2.1.2.3. UniFR supports only those driver DLL modules listed in FiscRegTypeID property.

2.1.2.4. Fiscal driver has FiscRegTypeNum property with: «Fiscal Type 1», «Fiscal Type 2», «Fiscal Type 3», "By name" - alternatives.

2.1.2.4.1. Value name will be the same as property name of currency and tax rate.

2.2. Other (native)

2.2.1. PRIM08 (TM200Plus)

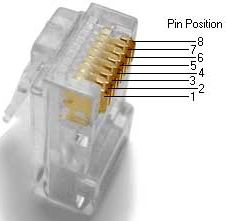

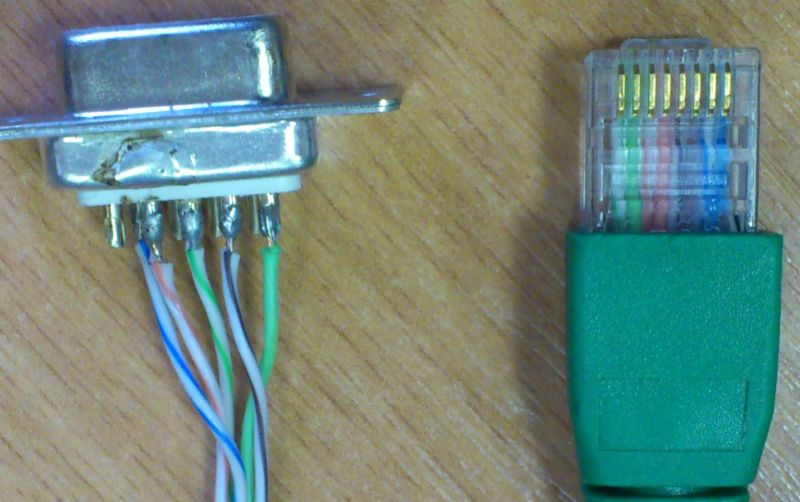

2.2.1.1. On fiscal board has RJ-45 COM port

2.2.1.1.1. Pinout for DB9(f)-RJ45(m) cable:

| Pin # on DB9 side (to PC) | Pin # on RJ45 side (to FP) | Purpose |

| 2 | 3 | RD |

| 3 | 1 | TD |

| 4 | 5 | DTR |

| 5 | 2 | GND |

| 6 | 7 | DSR |

2.2.2. SHTRIH FRK

2.2.2.1. This fiscal register is able to print zero amount for items and zero total receipts.

2.2.2.2. Driver filename is SHFRK.DLL. Programming FR since version 36.

2.2.2.3. Currency fiscal types: 1-4. 1-Cash, 2-4 no change.

2.2.2.4. Tax rate fiscal types: 1 to 4, 0 – no tax.

2.2.2.5. Departments: from 0 to 15, assign with "FR department" classification categories. Use parameter "Define department by classification category": 0 - default (no category assigned). FR will get value +1.

2.2.3. Other

2.2.3.1. Some fiscal drivers have the following properties (settings):

2.2.3.1.1. Curreny type - integer value 1-8. Cash - 8; Card (bank) - 7; Check - 6; Loyalty card - 1-5.

2.2.3.1.2. Department - int (from 0 to 98), assign using "FR department" parameter. 0 - default (in case no category assigned to item). Fiscal device will receive +1 value.

2.2.3.1.3. Baud - int (from 9600 to 115200) – COM port "speed".

2.2.3.1.4. Psw – FR access password (default is 000000). Alternative parameter Password (AERF).

2.2.3.1.5. Cashier – FR cashier password (default is 11111).

2.2.3.1.6. DebugLogFile – file name for events logging. Disable log in case empty value.

2.2.3.1.7. LineLen – single line length (usually 40 symbols).

2.2.3.1.8. FiscRegTypeNum – payment type number, for identification of payment type. Default is Fiscal Type 1.

2.2.3.1.9. NeedWorkToStart – on cash station start, check driver initiated (Yes).

2.2.3.1.10. PrintCheckTrys – number of tries to print receipt in case error happened.

2.2.3.1.11. CorrDiscName – rounding correction discount name.

2.2.3.1.12. SummaryText – in case "sum only" set, this text will be shown on item line.

2.2.3.1.13. DelAsRet - delete as return. No - delete as void, Yes - as return.

2.2.3.1.14. MaxLogLevel – Log detail level. "DebugLogFile" must be set non-empty.

2.2.3.1.15. POS Number – cash station number printed on receipts.

2.2.3.1.16. Cashier Name – the text to be printed on receipt as cashier name. It may influence on cashier password.

2.2.3.1.17. PrintTextDocs – use unfiscal printing.

2.2.3.1.18. CodeFormat – item code format. %d is code value. Example: "Item code %d". Empty value - do not print code.

2.2.3.1.19. AutoProgramTime – program time (in fiscal device from cash server computer).

2.2.3.1.20. AutoProgramTaxes – program taxes in FR from RK7 references.

2.2.3.1.21. AutoCloseShift – close fiscal shift (print Z-report) automatically, in case error "need fiscal shift close" returned by FR. If "yes" - shift will be closed automatically (default - No).

2.2.3.1.22. UseDepartments – send department to FR with items. Yes – send only receipt total, No - send each item department.

2.2.3.1.23. DefDepartName - Default department name for use with departments ON (default: Department 1).

2.2.3.1.24. Z report clear money - automatic encashment with close shift (default - No)

2.2.3.1.25. AutoProgramDeparts – program departments by category names in chosen classification.

2.2.3.1.26. OperPsw – password for regular commands (default: 1).

2.2.3.1.27. AdminPsw – password for extra commands (like Z report) to FR (default: 30).

2.2.3.1.28. UnfiscalPrintingTapes – choose Tapes to print data (default: Print to both tapes).

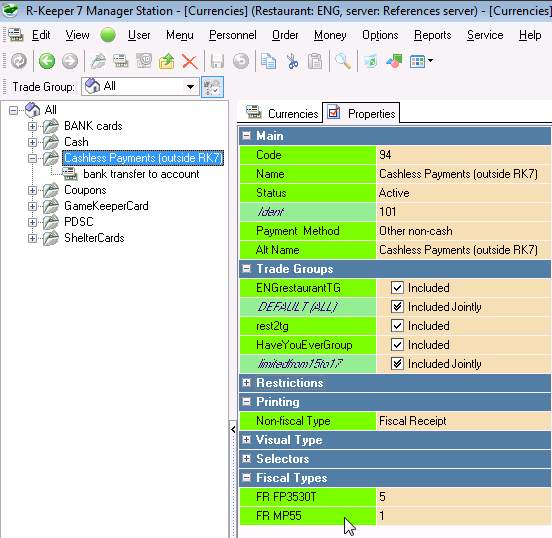

3. Fiscal type

3.1. Sale objects are usually separated by type in fiscal device internal preset dataschemes. 'Fiscal type' is the identifier of object type. There are different 'fiscal types' kinds: for tax rate and currency.

3.2. You assign 'Fiscal type' in 'Currency group' or 'Currency' properties. Group property sets 'Currency' property by default (used if not changed-overriden in currency properties).

3.3. You may set that in each currency properties overriding 'currency group' value (usually not necessary).

3.4. Unused fields "Fiscal type 1", "Fiscal type 2", "Fiscal type 3", FR name to be hidden until you choose value in parameter "FiscRegTypeNum" at least in one driver.

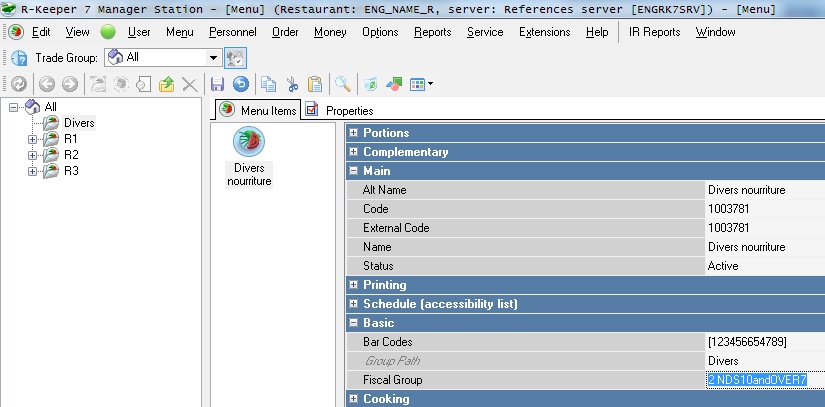

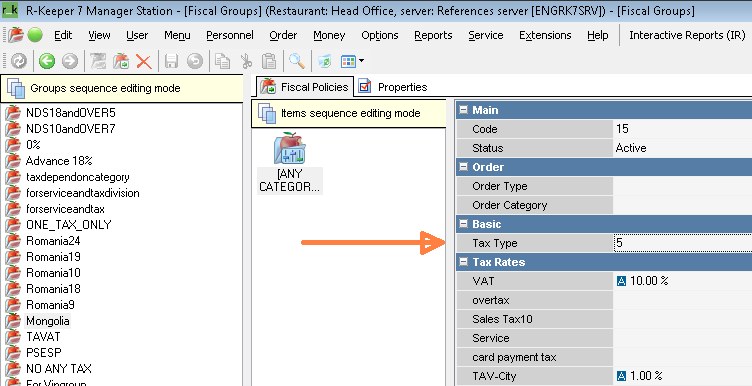

4. Fiscal group

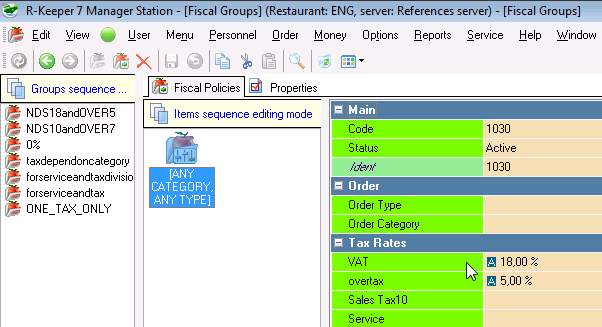

4.1. Fiscal group is a set of taxes to apply in defined conditions.

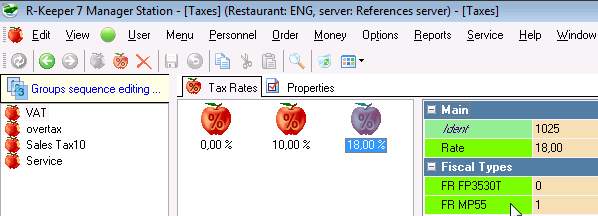

4.2. Each 'tax rate' has 'Fiscal type' assignment. This 'Fiscal type' is the tax identifier (could be numeric or literal) from fiscal device firmware. Possible identifiers are restricted by fiscal device and strict! You cannot leave or put any random value here.

4.2.1. Tax rates have those properties named as fiscal drivers. Additional index is applied in case several same drivers: Fiscal type 1, Fiscal type 2, Fiscal type 3.

4.2.2. Values are integer numbers. Value =0 – default or unused.

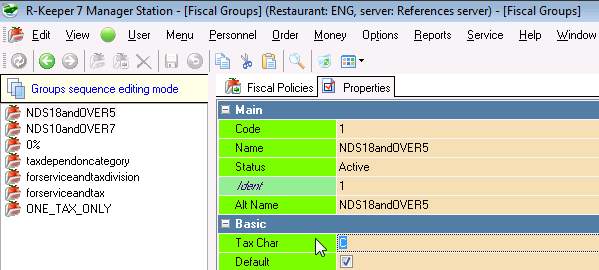

4.3. In fiscal group(s) properties you might set Tax character (deprecated, used before for some fiscal devices).

4.4. In RK7 system you must assign Fiscal group to each menu item and undistributable markup separately.

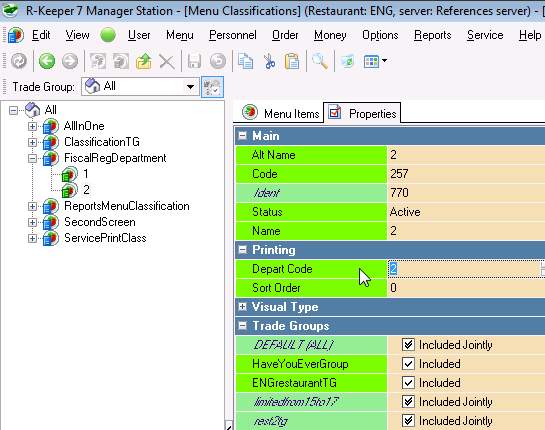

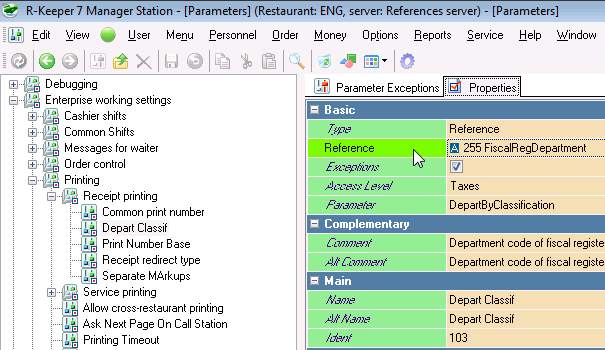

5. Department

5.1. Department - is the organisation subdivision, where accounting goes partially separately from other subdivisions, but they use 1 fiscal printer from some case.

5.2. Usually, you sell different goods in each subdivision - so that 1 good cannot be sold in several subdivisions at the same time. Hence, you use 'menu classifications' to assign department.

5.3. Which classification to use as Fiscal one you set in parameter 'Department classification'.

6. Fiscal operations

6.1. Print receipt (fiscal print)

6.1.1. This one is the main one. This operation goes on order payment (close order) and the sales data is sent to fiscal memory to be saved.

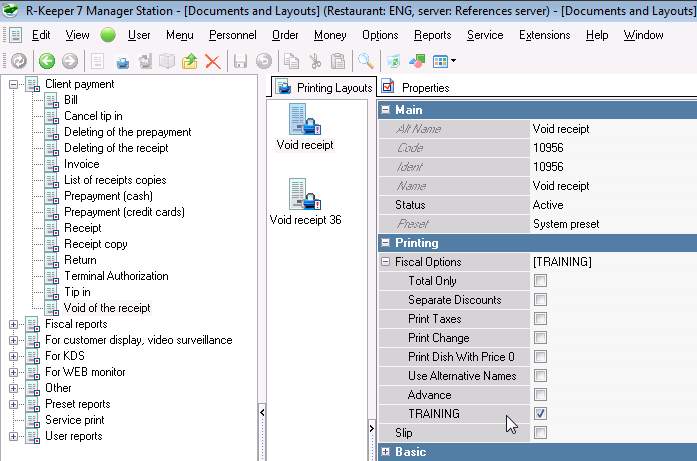

6.2. Fiscal void

6.2.1. RK7 operations Undo and Delete receipt are both reasons of fiscal void of payment operation.

6.2.2. Some fiscal device do not support voids or voiding in fiscal memory is prohibited by the law, that's why you have to do accounting void procedure, not RK7 one.

6.2.3. Otherwise, you may set "training" mode for fiscal document (will be sent as non-fiscal print).

6.3. Non-fiscal print

6.3.1. This option is for documents that are going to be printed to fiscal printer just as is, without being saved to fiscal memory, like to regular printer - so, just a print job (for reports, terminal slips, coupons, etc.).

7. Tax type

7.1. Tax type - common attribute for the whole receipt, which identifies the main way of tax calculation chosen.

7.2. This property of the fiscal policy can be set as integer value

7.3. "Tax type" value must be used by fiscal driver(s) for proper calculation of taxes. It is supported by several modern fiscal drivers only.

7.4. Each receipt must have only one tax type.

7.4.1. In case order has items with different Tax types, the system will split it into several receipts automatically.