- Here you can add goods, using one of the methods

- The # and Goods code fields will be filled in automatically

- By default, the UOM field contains the base unit of measurement for the selected goods. If you want to use another UOM for the incoming goods, select it from the list. If the quantity of goods in the corresponding field was specified, it will be automatically recalculated in accordance with the selected UOM

- In the Quantity field, specify the quantity of received goods in the selected UOM

- The Gross (G) field is filled in, when it is necessary to specify the weight of goods in incomplete tare — for goods for which a tare with a given weight is specified in the goods card on the UOM tab in the UOM field. The value in the Gross (G) field depends on the coefficient specified in the goods card for the selected UOM and is the sum of the goods weight and tare weight. In addition, the value in the Quantity field should not exceed 1. If you specify a bigger value, the system will display an error message. If you need to specify several containers with goods, indicate each in a separate line

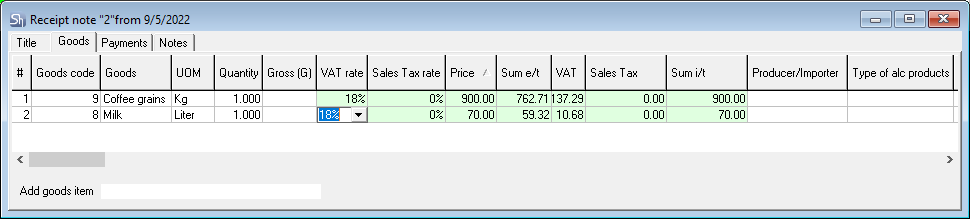

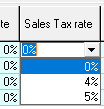

- VAT rate/Sales Tax rate — by default, when adding goods to the receipt note, VAT rate/Sales Tax rate is determined automatically by the system. If the user has rights to change the automatically determined tax rate, then the rate can be set manually by selecting from the drop-down list

The list of VAT rates/Sales Tax rates is defined in the VAT rates/Sales Tax rates dictionary

- Filling in the Price, Sum e/t, VAT, Sales Tax and Sum i/t are interconnected:

By default, when adding goods to the receipt note, the Price is determined automatically by the system. If the user has rights to change the automatically determined price, then the price/sum can be set manually

Which price — Sum i/t or Sum e/t — to use when creating a receipt note is determined in the Service > Environment Settings ... > Other warehouse settings menu.

- You can specify the price for the UOM you have chosen in the Price field. In this case, after specifying the price, the sums i/t and e/t will be calculated automatically

- You can enter the sum e/t (excluding taxes) or i/t (including taxes), then the price and the second sum will be calculated automatically

- The values in the VAT and Sales Tax fields are calculated automatically depending on the selected rates in the corresponding fields

When calculating the sum i/t, the amount of VAT is added to the sum w/t, then the Sales Tax amount is calculated from the received amount and is added to the value obtained by adding the sum w/t and the VAT amount

- When editing the Price/Sum, the background of the field can highlight the price change relative to the price of the last receipt note. To do this, specify the difference in the Environment Settings... > Other warehouse settings menu

- After saving the document, the highlighting of the price is removed.

Price of the last receipt — the last receipt note is selected from all receipt notes with the selected goods for the department, indicated in the note header OR for all departments of the enterprise, which is determined relative to the specified department in the current receipt note. The method of the last receipt note selection is determined in the SDBMan.exe settings.

Red background — if the price of the current receipt note is higher than the price of the last receipt by more than the difference specified in the settings.

Yellow background — if the price of the current receipt note is less than the price of the last receipt by more than the difference specified in the settings.

If the difference is less than specified in the settings, then the price change will not be highlighted.

- You can also set the purchase price using the Set amounts... item

- In the Balances field, before saving the document, the remaining goods are automatically displayed at the department that you selected in the Recipient field on the Title tab

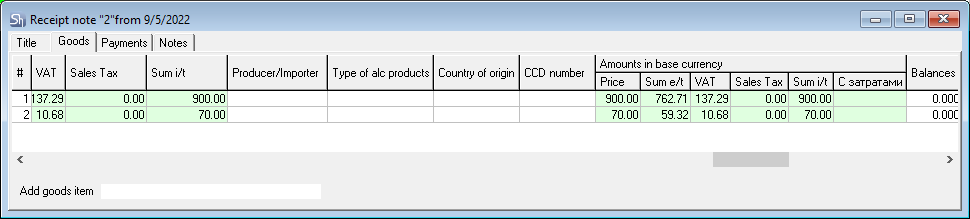

- The Producer/Importer field is filled in for goods, in the card of which, on the Main parameters tab, the alcoholic products flag is set. The value in the field is selected from the list of producers/importers specified in the goods card on the Manufacturers tab. By default, the receipt note contains the Producer/Importer, which has the By default flag set in the goods card on the Manufacturers tab

- The Type of alc products field is also filled in for goods, in the card of which the alcoholic products flag is set on the Main parameters tab. The field is automatically filled with the Code of alcoholic beverages specified in the goods card on the Main parameters tab. If necessary, the Code of alcoholic beverages can be manually edited in the document. For all other goods, this field remains empty

- CCD number — the number of the cargo customs declaration. The field is filled for all imported goods for the correct formation of the invoice. Also, this field is filled in for imported alcoholic products in case of building the Alcohol declaration report. The value is selected from the drop-down list of ССD numbers. The list is defined in the ССВ List dictionary

- Country of origin is an optional field. The field must be filled in for the correct formation of the invoice. The value is selected from the drop-down list of countries. The list is combined in the Countries dictionary

- The Price, Sum e/t, VAT, Sales Tax, Sum i/t fields of the Amounts in the base currency section are filled in automatically in the base currency and are calculated depending on the selected currency and exchange rate on the Title tab. If the currency selected in the note matches the base currency, the amounts in the fields will match the fields of the same name described above.

After all settings, save the document, using the Document > Save document main menu item or the button on the toolbar.